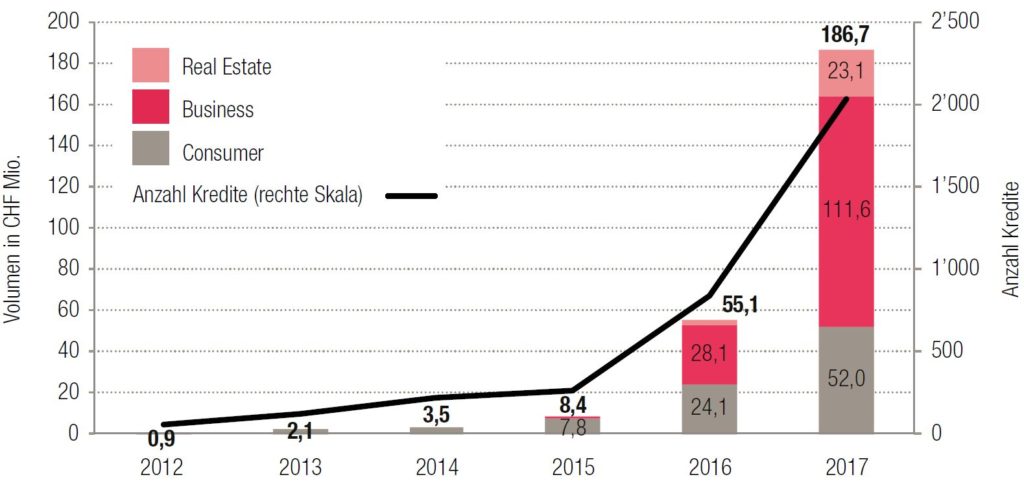

Crowdlending, also known as peer-to-peer lending, is taking off in Switzerland with domestic platforms allocating a volume of CHF 186.7 million in loans in 2017, a 240% increase from the previous year.

According to the 2018 Crowdlending Survey by the Lucerne University of Applied Sciences and Arts, the Swiss Marketplace Lending Association and PwC, a market volume of CHF 400-500 million may be reached in the current year.

Of the CHF 186.7 million lent through online platforms in 2017, CHF 111.6 million went towards business loans, CHF 52 million to consumer loans and CHF 23.1 million to real estate loans. Business crowdlending volume grew by 297% from 2016’s CHF 28.1 million, consumer crowdlending more than doubled, and real estate crowdlending saw CHF 23.1 million brokered last year, a 696% increased compared to 2016’s CHF 2.9 million in volume.

Swiss crowdlending startups

At the end of 2017, there were a total of 15 active crowdlending platforms in Switzerland. Seven new platforms entered the market in 2016 (Creditworld, Lendico, Swisspeers, Lend, Lendora, SwissLending, Hyposcout and 3circlefunding) and three additional platforms (Acredius, Creditfolio and Crowd4Cash) launched in the past year.

While most of these mainly focus on one or two segments within crowdlending, two platforms, namely Cashare and CreditGate24, offer business, consumer and real estate crowdlending. Advanon is another noteworthy startup, which although offers a platform for invoice trading also provides unsecured short-term loans, meaning that the platform is also categorized as in the crowdlending space.

But in the Swiss crowdlending space, other business models in marketplace lending exist. For instance, Loanboox is an online brokering platform for public corporations and professional investors. Municipalities, cities and cantons can submit applications for loans from CHF 500,000 to CHF 500 million. Loanboox was the first platform in Switzerland to broker loans for the public sector online.

Another example is Remaco, which operates a corporate direct lending model. The Remaco Direct lending platform brings together companies that are seeking capital with a group of professional, qualified investors. As an alternative to bank loans, companies can procure their capital directly on the Remaco platform.

Swiss peer-to-peer lending still behind world leaders

Despite the tremendous growth of the Swiss crowdlending industry, Switzerland is still behind well-developed crowdlending markets such the UK or the US.

In 2016, China had the world’s largest crowdlending market, which amounted to CHF 198.7 billion. China is followed by the US with CHF 23 billion, and the UK with CHF 4.7 billion. In comparison, the Swiss crowdlending activity stood at only CHF 55.1 million in terms of volume in 2016.

Switzerland was also out shadowed by Japan where CHF 367 million in loans were allocated through online platforms in 2016, as well as France with CHF 272 million, and Germany with CHF 223 million.

Despite Switzerland’s late start in the crowdlending space, figures suggest that the country is quickly catching up. The report claims that there is potential for improvement in the regulatory landscape which could boost crowdlending activity.

Developments have already been made in this regard, notably through the introduction of the Fintech regulation in the summer of 2017 which cut back legislative hurdles for fintech companies.

In particular, the limit of 20 lenders per project was softened in that it now only applies for loans of more CHF 1 million. However, the limitation has only been abolished for business loans, and in the consumer crowdlending and real estate crowdlending segments, the ruling still applies.

The report suggests that the limit of 20 lenders per project should be abolished for all three segments in the Swiss crowdlending market.

The Fintech regulation also extended the maximum period for retaining funds for processing purposes to 60 days from seven initially. The amendment was welcomed by the industry as it greatly simplified loan processes.