Congratulations on registering with 3CF. We’re happy that you have decided to be part of our community In order to actively partake on the 3CF platform, you will need to decide if you would like to be an investor or a borrower. Completing the registration process is simple and takes about 7 minutes. Below is the step-by-step process.

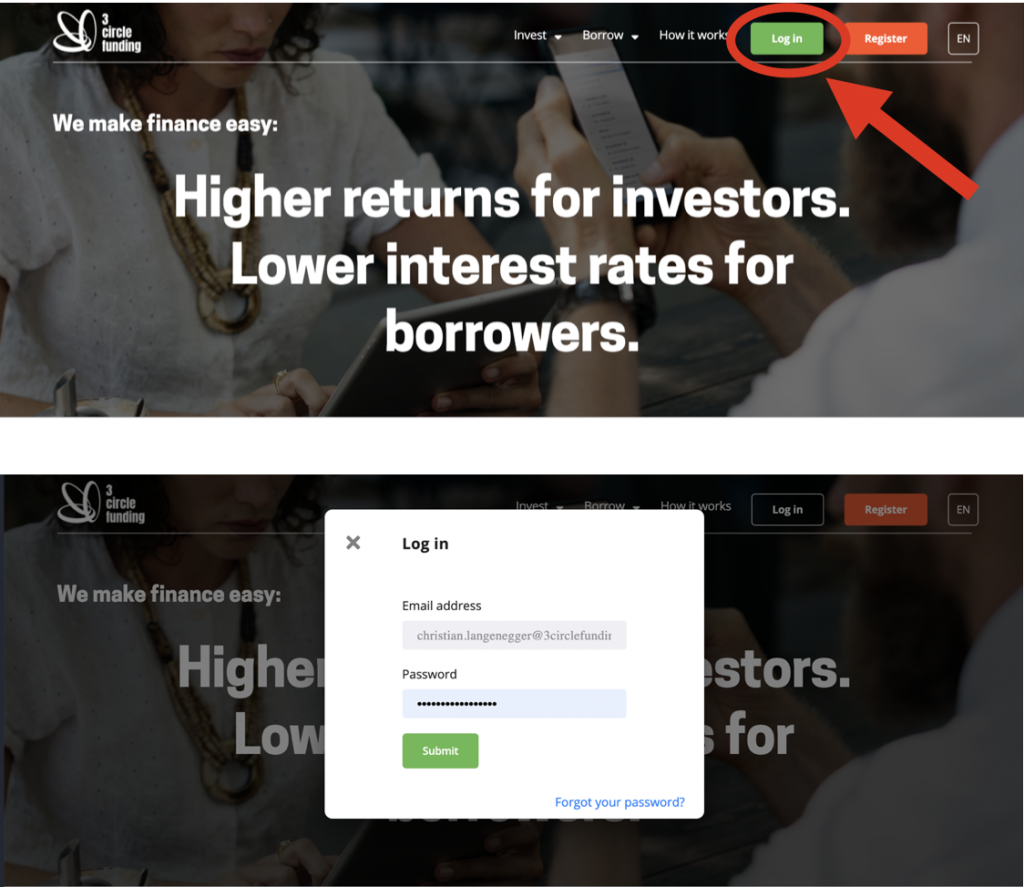

1. Log in to the platform with your e-mail and password.

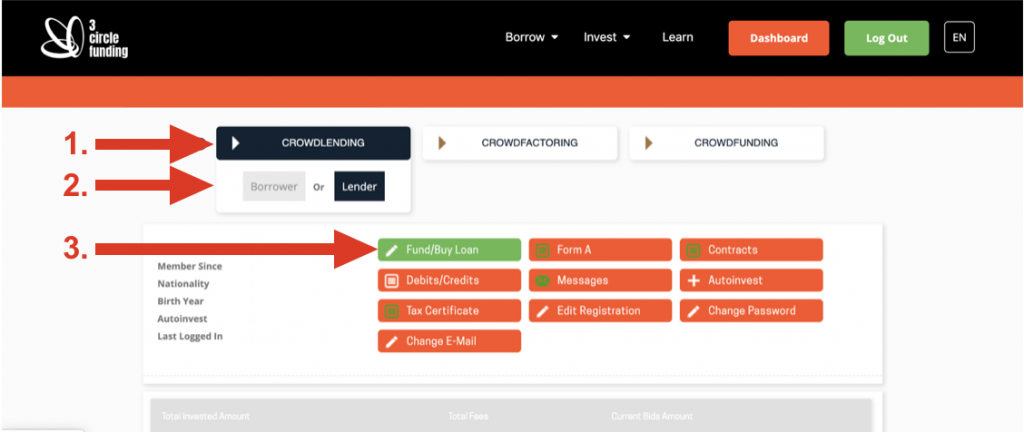

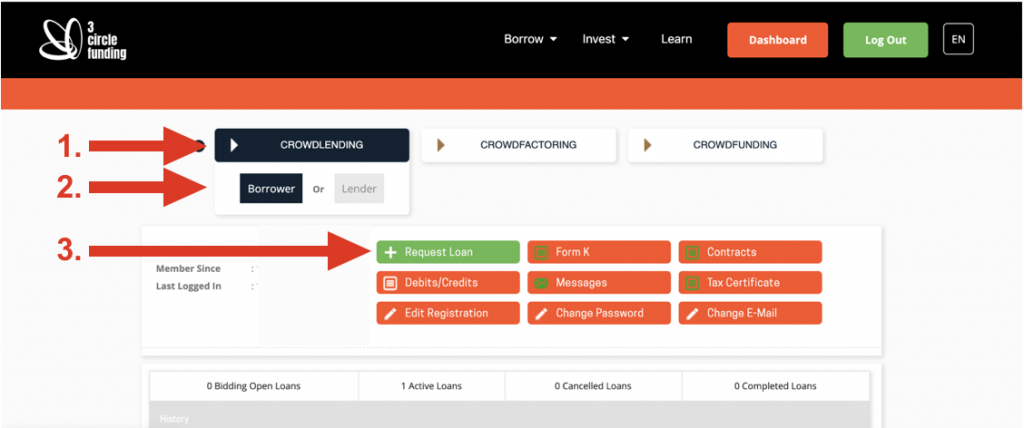

2. Select “Crowdlending” at the top of your dashboard.

3. Select if you would like to be a “Lender” or “Borrower”

4. If you would like to be a “Lender”, click the “Buy/Fund Loan” button and complete the application.

5. If you would like to be a “Borrower,” click the “Request Loan” button and complete the application

6. Press the “Submit” button at the end of the registration form

7. Borrowers must pay the application fee to have their loan application checked. This fee covers the costs of the required credit checks.

Which documents do investors (lenders) need to complete their registration?

Private persons wishing to become an investor (lender) on the 3CF platform only need to provide a copy of their passport.

Those applying to invest as a company must provide a copy of their personal passport and a copy of their trade register that certifies that they have signatory rights for the company.

Why does 3CF need a copy of your passport?

3CF requires a copy of your passport for KYC (know your customer). Under Swiss law, we are obligated to identify all platform users and ensure that they are not involved in any financial crimes such as money laundering.

Which documents do borrowers need to complete their registration?

Private individuals applying as borrowers require more information. We recommend that you have all of these documents on hand before you try to complete the registration form. You will need:

- Personal Passport

- Copy of your rental contract or mortgage

- Two (2) of your most recent payslips

- One (1) recent utility bills like mobile phone, electricity, internet

- A copy of your most recent health insurance bill

Businesses applying for a loan need to provide the following:

- Personal Passport

- Copy of the Trade Register showing the applicant is a legal signatory

- Business financials – preferably 3 years.

Why do borrowers need more documents?

Borrowers require more documents because we also need to ensure that you are able to pay back the loan. Under Swiss law, we cannot provide loans to people at risk of becoming over-indebted. Providing these documents allows us to do both a credit check and ensure that your loan is safe for investors on our platform.

How can borrowers get funded faster/better?

Finance is an activity of trust and chance. A loan is a promise to pay back a debt. Borrowers that have a good credit rating and are offering a fair interest rate are more likely to get funded. On top of that and important for Crowdlending, is a good reason for the loan. Investors want to know that they are helping private individuals and businesses while also earning a fair return. We recommend spending some time discussing the reason for the loan, what you hope to achieve with it and the plans for paying it back.